Page 179 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 179

Interest Rate Risk management

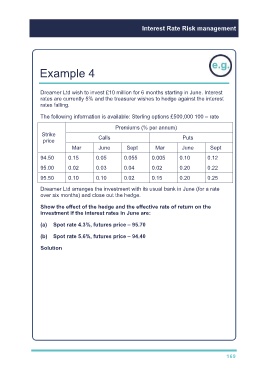

Example 4

Dreamer Ltd wish to invest £10 million for 6 months starting in June. Interest

rates are currently 5% and the treasurer wishes to hedge against the interest

rates falling.

The following information is available: Sterling options £500,000 100 – rate

Premiums (% per annum)

Strike Calls Puts

price

Mar June Sept Mar June Sept

94.50 0.15 0.05 0.055 0.005 0.10 0.12

95.00 0.02 0.03 0.04 0.02 0.20 0.22

95.50 0.10 0.10 0.02 0.15 0.20 0.25

Dreamer Ltd arranges the investment with its usual bank in June (for a rate

over six months) and close out the hedge.

Show the effect of the hedge and the effective rate of return on the

investment if the interest rates in June are:

(a) Spot rate 4.3%, futures price – 95.70

(b) Spot rate 5.6%, futures price – 94.40

Solution

Put or call?

We are investing, so we need to be in a position to benefit if rates go down. If

rates go down the price will rise, so we want the option to buy – a call.

How many contracts?

Size of loan Duration of loan

Number of contracts = ×

Size of contract Duration of contract

= (10,000,000/500,000) × (6 months/3 months)

= 20 × 2 = 40

169