Page 197 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 197

Cost of capital and capital investment decisions

The Capital Asset Pricing Model (CAPM)

5.1 Key elements of CAPM

A methodology for measuring business risk.

An equation for determining what level of required return is needed to

compensate for the measured level of risk.

5.2 Systematic and unsystematic risk

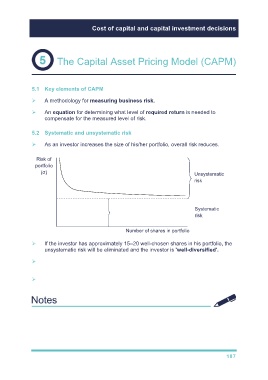

As an investor increases the size of his/her portfolio, overall risk reduces.

Risk of

portfolio

(σ) Unsystematic

risk

Systematic

risk

Number of shares in portfolio

If the investor has approximately 15–20 well-chosen shares in his portfolio, the

unsystematic risk will be eliminated and the investor is 'well-diversified'.

Systematic risk is caused by general, macro-economic factors (e.g. recession,

interest rates, exchange rates). It cannot be diversified away.

Unsystematic risk is caused by factors specific to the company or industry (e.g.

systems failure, R+D success, strikes).

187