Page 224 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 224

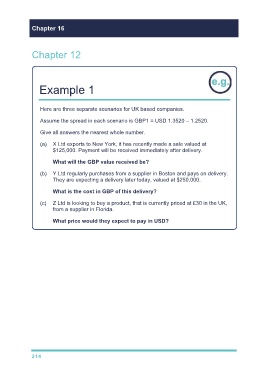

Chapter 16

Chapter 12

Example 1

Here are three separate scenarios for UK based companies.

Assume the spread in each scenario is GBP1 = USD 1.3520 – 1.2520.

Give all answers the nearest whole number.

(a) X Ltd exports to New York, it has recently made a sale valued at

$125,000. Payment will be received immediately after delivery.

What will the GBP value received be?

(b) Y Ltd regularly purchases from a supplier in Boston and pays on delivery.

They are expecting a delivery later today, valued at $250,000.

What is the cost in GBP of this delivery?

(c) Z Ltd is looking to buy a product, that is currently priced at £30 in the UK,

from a supplier in Florida.

What price would they expect to pay in USD?

214