Page 237 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 237

Answers to examples

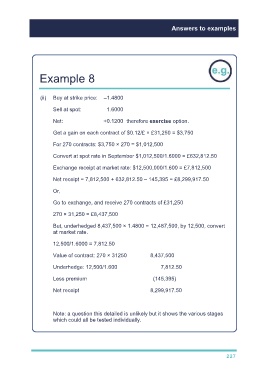

Example 8

(ii) Buy at strike price: –1.4800

Sell at spot: 1.6000

Net: +0.1200 therefore exercise option.

Get a gain on each contract of $0.12/£ × £31,250 = $3,750

For 270 contracts: $3,750 × 270 = $1,012,500

Convert at spot rate in September $1,012,500/1.6000 = £632,812.50

Exchange receipt at market rate: $12,500,000/1.600 = £7,812,500

Net receipt = 7,812,500 + 632,812.50 – 145,395 = £8,299,917.50

Or,

Go to exchange, and receive 270 contracts of £31,250

270 × 31,250 = £8,437,500

But, underhedged 8,437,500 × 1.4800 = 12,487,500, by 12,500, convert

at market rate.

12,500/1.6000 = 7,812.50

Value of contract: 270 × 31250 8,437,500

Underhedge: 12,500/1.600 7,812.50

Less premium (145,395)

Net receipt 8,299,917.50

Note: a question this detailed is unlikely but it shows the various stages

which could all be tested individually.

227