Page 240 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 240

Chapter 16

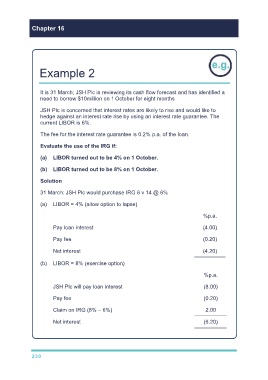

Example 2

It is 31 March; JSH Plc is reviewing its cash flow forecast and has identified a

need to borrow $10million on 1 October for eight months

JSH Plc is concerned that interest rates are likely to rise and would like to

hedge against an interest rate rise by using an interest rate guarantee. The

current LIBOR is 6%.

The fee for the interest rate guarantee is 0.2% p.a. of the loan.

Evaluate the use of the IRG if:

(a) LIBOR turned out to be 4% on 1 October.

(b) LIBOR turned out to be 8% on 1 October.

Solution

31 March: JSH Plc would purchase IRG 6 v 14 @ 6%

(a) LIBOR = 4% (allow option to lapse)

%p.a.

Pay loan interest (4.00)

Pay fee (0.20)

Net interest (4.20)

(b) LIBOR = 8% (exercise option)

%p.a.

JSH Plc will pay loan interest (8.00)

Pay fee (0.20)

Claim on IRG (8% – 6%) 2.00

Net interest (6.20)

230