Page 244 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 244

Chapter 16

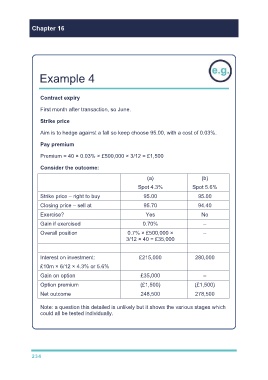

Example 4

Contract expiry

First month after transaction, so June.

Strike price

Aim is to hedge against a fall so keep choose 95.00, with a cost of 0.03%.

Pay premium

Premium = 40 × 0.03% × £500,000 × 3/12 = £1,500

Consider the outcome:

(a) (b)

Spot 4.3% Spot 5.6%

Strike price – right to buy 95.00 95.00

Closing price – sell at 95.70 94.40

Exercise? Yes No

Gain if exercised 0.70% –

Overall position 0.7% × £500,000 × –

3/12 × 40 = £35,000

Interest on investment: £215,000 280,000

£10m × 6/12 × 4.3% or 5.6%

Gain on option £35,000 –

Option premium (£1,500) (£1,500)

Net outcome 248,500 278,500

Note: a question this detailed is unlikely but it shows the various stages which

could all be tested individually.

234