Page 277 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 277

Exam style questions and answers

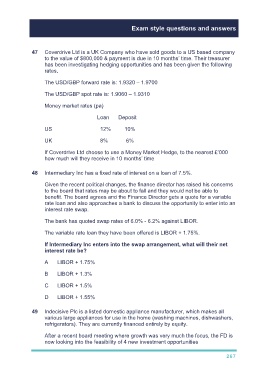

47 Coverdrive Ltd is a UK Company who have sold goods to a US based company

to the value of $800,000 & payment is due in 10 months’ time. Their treasurer

has been investigating hedging opportunities and has been given the following

rates.

The USD/GBP forward rate is: 1.9320 – 1.9700

The USD/GBP spot rate is: 1.9060 – 1.9310

Money market rates (pa)

Loan Deposit

US 12% 10%

UK 8% 6%

If Coverdrive Ltd choose to use a Money Market Hedge, to the nearest £’000

how much will they receive in 10 months’ time

48 Intermediary Inc has a fixed rate of interest on a loan of 7.5%.

Given the recent political changes, the finance director has raised his concerns

to the board that rates may be about to fall and they would not be able to

benefit. The board agrees and the Finance Director gets a quote for a variable

rate loan and also approaches a bank to discuss the opportunity to enter into an

interest rate swap.

The bank has quoted swap rates of 6.0% - 6.2% against LIBOR.

The variable rate loan they have been offered is LIBOR + 1.75%.

If Intermediary Inc enters into the swap arrangement, what will their net

interest rate be?

A LIBOR + 1.75%

B LIBOR + 1.3%

C LIBOR + 1.5%

D LIBOR + 1.55%

49 Indecisive Plc is a listed domestic appliance manufacturer, which makes all

various large appliances for use in the home (washing machines, dishwashers,

refrigerators). They are currently financed entirely by equity.

After a recent board meeting where growth was very much the focus, the FD is

now looking into the feasibility of 4 new investment opportunities

267