Page 75 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 75

Management control systems

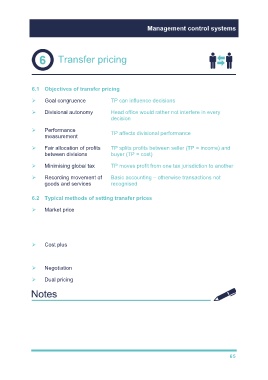

Transfer pricing

6.1 Objectives of transfer pricing

Goal congruence TP can influence decisions

Divisional autonomy Head office would rather not interfere in every

decision

Performance TP affects divisional performance

measurement

Fair allocation of profits TP splits profits between seller (TP = income) and

between divisions buyer (TP = cost)

Minimising global tax TP moves profit from one tax jurisdiction to another

Recording movement of Basic accounting – otherwise transactions not

goods and services recognised

6.2 Typical methods of setting transfer prices

Market price If one exists!

Usually results in goal congruence

May be adjusted for selling/buying costs

Cost plus Which cost?

Actual cost may result in inefficiencies

Negotiation One division may have more power

Dual pricing Different TPs for seller/buyer

65