Page 33 - FINAL CFA I SLIDES JUNE 2019 DAY 11

P. 33

Session Unit 12:

40. Risk Management: An Introduction

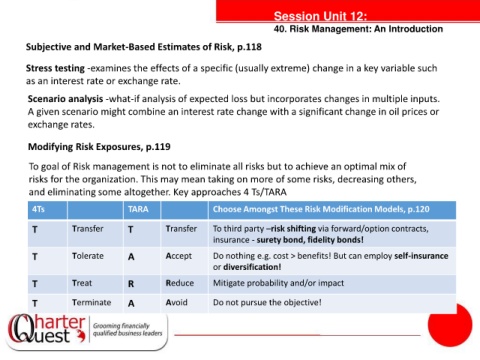

Subjective and Market-Based Estimates of Risk, p.118

Stress testing -examines the effects of a specific (usually extreme) change in a key variable such

as an interest rate or exchange rate.

Scenario analysis -what-if analysis of expected loss but incorporates changes in multiple inputs.

A given scenario might combine an interest rate change with a significant change in oil prices or

exchange rates.

Modifying Risk Exposures, p.119 tanties

To goal of Risk management is not to eliminate all risks but to achieve an optimal mix of

risks for the organization. This may mean taking on more of some risks, decreasing others,

and eliminating some altogether. Key approaches 4 Ts/TARA

4Ts TARA Choose Amongst These Risk Modification Models, p.120

T Transfer T Transfer To third party –risk shifting via forward/option contracts,

insurance - surety bond, fidelity bonds!

T Tolerate A Accept Do nothing e.g. cost > benefits! But can employ self-insurance

or diversification!

T Treat R Reduce Mitigate probability and/or impact

T Terminate A Avoid Do not pursue the objective!