Page 37 - FINAL CFA I SLIDES JUNE 2019 DAY 11

P. 37

LOS 41.b: Describe characteristics of Session Unit 12:

the major asset classes that investors 41. Portfolio Risk and Return: Part 1

consider in forming portfolios., p.128

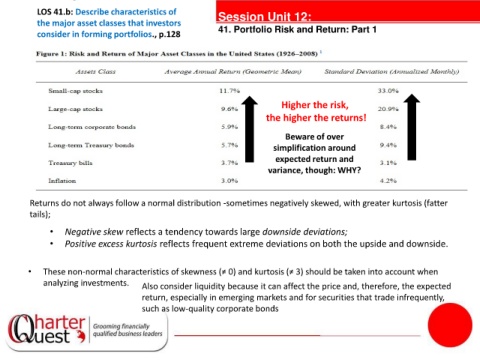

Higher the risk,

the higher the returns!

Beware of over

tanties

simplification around

expected return and

variance, though: WHY?

Returns do not always follow a normal distribution -sometimes negatively skewed, with greater kurtosis (fatter

tails);

• Negative skew reflects a tendency towards large downside deviations;

• Positive excess kurtosis reflects frequent extreme deviations on both the upside and downside.

• These non-normal characteristics of skewness (≠ 0) and kurtosis (≠ 3) should be taken into account when

analyzing investments. Also consider liquidity because it can affect the price and, therefore, the expected

return, especially in emerging markets and for securities that trade infrequently,

such as low-quality corporate bonds