Page 40 - FINAL CFA I SLIDES JUNE 2019 DAY 11

P. 40

LOS 41.d: Explain risk aversion and its Session Unit 12:

implications for portfolio selection., p.132 41. Portfolio Risk and Return: Part 1

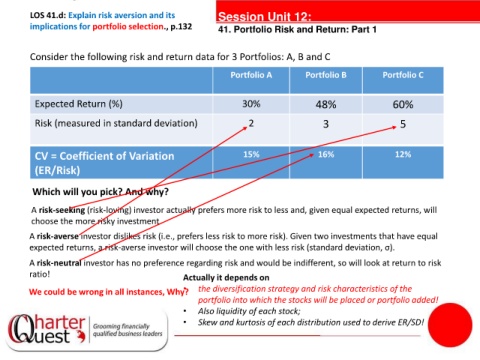

Consider the following risk and return data for 3 Portfolios: A, B and C

Portfolio A Portfolio B Portfolio C

Expected Return (%) 30% 48% 60%

Risk (measured in standard deviation) 2 3 5

15%

CV = Coefficient of Variation tanties 16% 12%

(ER/Risk)

Which will you pick? And why?

A risk-seeking (risk-loving) investor actually prefers more risk to less and, given equal expected returns, will

choose the more risky investment.

A risk-averse investor dislikes risk (i.e., prefers less risk to more risk). Given two investments that have equal

expected returns, a risk-averse investor will choose the one with less risk (standard deviation, σ).

A risk-neutral investor has no preference regarding risk and would be indifferent, so will look at return to risk

ratio! Actually it depends on

• the diversification strategy and risk characteristics of the

We could be wrong in all instances, Why?

portfolio into which the stocks will be placed or portfolio added!

• Also liquidity of each stock;

• Skew and kurtosis of each distribution used to derive ER/SD!