Page 47 - FINAL CFA I SLIDES JUNE 2019 DAY 11

P. 47

Session Unit 12:

p.140! 41. Portfolio Risk and Return: Part 1

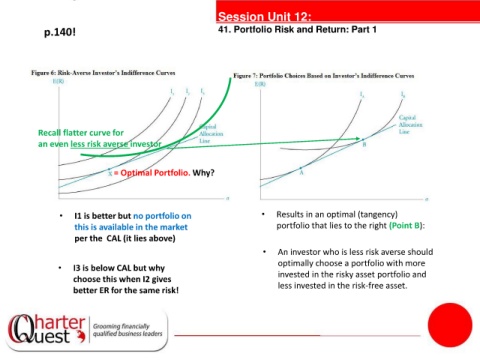

Recall flatter curve for

an even less risk averse investor

tanties

= Optimal Portfolio. Why?

• I1 is better but no portfolio on • Results in an optimal (tangency)

this is available in the market portfolio that lies to the right (Point B):

per the CAL (it lies above)

• An investor who is less risk averse should

• I3 is below CAL but why optimally choose a portfolio with more

invested in the risky asset portfolio and

choose this when I2 gives

better ER for the same risk! less invested in the risk-free asset.