Page 22 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 22

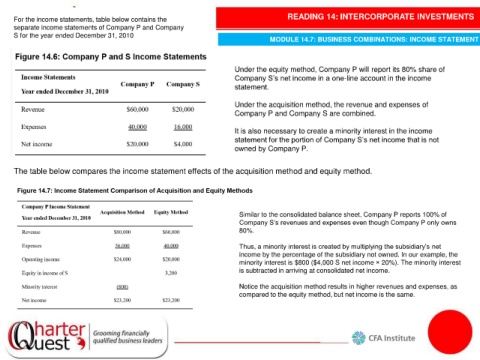

For the income statements, table below contains the READING 14: INTERCORPORATE INVESTMENTS

separate income statements of Company P and Company

S for the year ended December 31, 2010

MODULE 14.7: BUSINESS COMBINATIONS: INCOME STATEMENT

Under the equity method, Company P will report its 80% share of

Company S’s net income in a one-line account in the income

statement.

Under the acquisition method, the revenue and expenses of

Company P and Company S are combined.

It is also necessary to create a minority interest in the income

statement for the portion of Company S’s net income that is not

owned by Company P.

The table below compares the income statement effects of the acquisition method and equity method.

Similar to the consolidated balance sheet, Company P reports 100% of

Company S’s revenues and expenses even though Company P only owns

80%.

Thus, a minority interest is created by multiplying the subsidiary’s net

income by the percentage of the subsidiary not owned. In our example, the

minority interest is $800 ($4,000 S net income × 20%). The minority interest

is subtracted in arriving at consolidated net income.

Notice the acquisition method results in higher revenues and expenses, as

compared to the equity method, but net income is the same.