Page 25 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 25

Under IFRS: READING 14: INTERCORPORATE INVESTMENTS

• If CV of the cash generating unit (where the goodwill is

assigned) > RV, an impairment loss is recognized.

MODULE 14.8: BUSINESS COMBINATIONS: GOODWILL

Under IFRS:

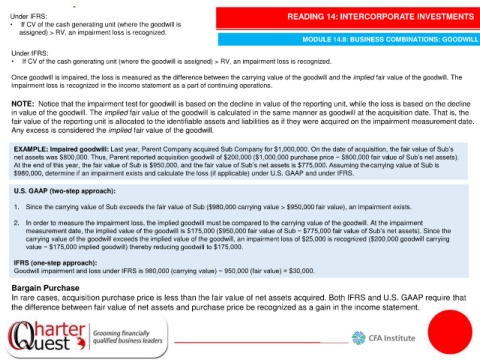

• If CV of the cash generating unit (where the goodwill is assigned) > RV, an impairment loss is recognized.

Once goodwill is impaired, the loss is measured as the difference between the carrying value of the goodwill and the implied fair value of the goodwill. The

impairment loss is recognized in the income statement as a part of continuing operations.

NOTE: Notice that the impairment test for goodwill is based on the decline in value of the reporting unit, while the loss is based on the decline

in value of the goodwill. The implied fair value of the goodwill is calculated in the same manner as goodwill at the acquisition date. That is, the

fair value of the reporting unit is allocated to the identifiable assets and liabilities as if they were acquired on the impairment measurement date.

Any excess is considered the implied fair value of the goodwill.

EXAMPLE: Impaired goodwill: Last year, Parent Company acquired Sub Company for $1,000,000. On the date of acquisition, the fair value of Sub’s

net assets was $800,000. Thus, Parent reported acquisition goodwill of $200,000 ($1,000,000 purchase price − $800,000 fair value of Sub’s net assets).

At the end of this year, the fair value of Sub is $950,000, and the fair value of Sub’s net assets is $775,000. Assuming the carrying value of Sub is

$980,000, determine if an impairment exists and calculate the loss (if applicable) under U.S. GAAP and under IFRS.

U.S. GAAP (two-step approach):

1. Since the carrying value of Sub exceeds the fair value of Sub ($980,000 carrying value > $950,000 fair value), an impairment exists.

2. In order to measure the impairment loss, the implied goodwill must be compared to the carrying value of the goodwill. At the impairment

measurement date, the implied value of the goodwill is $175,000 ($950,000 fair value of Sub − $775,000 fair value of Sub’s net assets). Since the

carrying value of the goodwill exceeds the implied value of the goodwill, an impairment loss of $25,000 is recognized ($200,000 goodwill carrying

value − $175,000 implied goodwill) thereby reducing goodwill to $175,000.

IFRS (one-step approach):

Goodwill impairment and loss under IFRS is 980,000 (carrying value) − 950,000 (fair value) = $30,000.

Bargain Purchase

In rare cases, acquisition purchase price is less than the fair value of net assets acquired. Both IFRS and U.S. GAAP require that

the difference between fair value of net assets and purchase price be recognized as a gain in the income statement.