Page 28 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 28

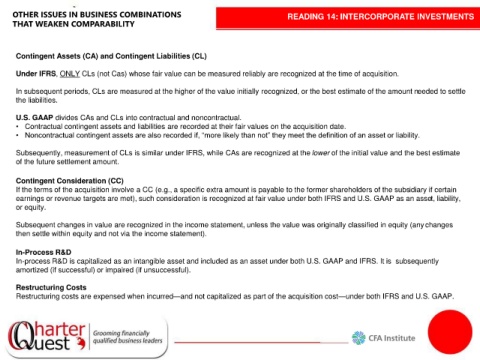

OTHER ISSUES IN BUSINESS COMBINATIONS READING 14: INTERCORPORATE INVESTMENTS

THAT WEAKEN COMPARABILITY

Contingent Assets (CA) and Contingent Liabilities (CL)

Under IFRS, ONLY CLs (not Cas) whose fair value can be measured reliably are recognized at the time of acquisition.

In subsequent periods, CLs are measured at the higher of the value initially recognized, or the best estimate of the amount needed to settle

the liabilities.

U.S. GAAP divides CAs and CLs into contractual and noncontractual.

• Contractual contingent assets and liabilities are recorded at their fair values on the acquisition date.

• Noncontractual contingent assets are also recorded if, “more likely than not” they meet the definition of an asset or liability.

Subsequently, measurement of CLs is similar under IFRS, while CAs are recognized at the lower of the initial value and the best estimate

of the future settlement amount.

Contingent Consideration (CC)

If the terms of the acquisition involve a CC (e.g., a specific extra amount is payable to the former shareholders of the subsidiary if certain

earnings or revenue targets are met), such consideration is recognized at fair value under both IFRS and U.S. GAAP as an asset, liability,

or equity.

Subsequent changes in value are recognized in the income statement, unless the value was originally classified in equity (anychanges

then settle within equity and not via the income statement).

In-Process R&D

In-process R&D is capitalized as an intangible asset and included as an asset under both U.S. GAAP and IFRS. It is subsequently

amortized (if successful) or impaired (if unsuccessful).

Restructuring Costs

Restructuring costs are expensed when incurred—and not capitalized as part of the acquisition cost—under both IFRS and U.S. GAAP.