Page 4 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 4

LOS 14.a: Describe the classification, measurement, and disclosure under International READING 14: INTERCORPORATE INVESTMENTS

Financial Reporting Standards (IFRS) for 1) investments in financial assets, 2)

investments in associates, 3) JVs, 4) business combinations, and 5) special purpose and

variable interest entities.

MODULE 14.1: CLASSIFICATIONS

LOS 14.b: Distinguish between IFRS and US GAAP in the classification, measurement,

and disclosure of investments in financial assets, investments in associates, joint

ventures, business combinations, and special purpose and variable interest entities.

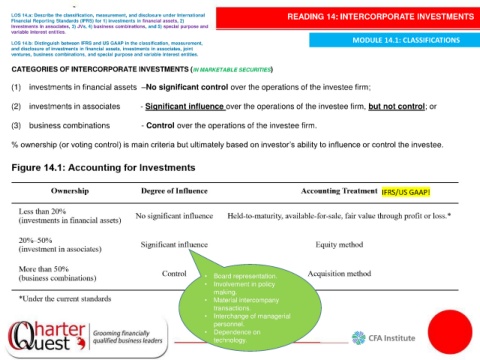

CATEGORIES OF INTERCORPORATE INVESTMENTS (IN MARKETABLE SECURITIES)

(1) investments in financial assets –No significant control over the operations of the investee firm;

(2) investments in associates - Significant influence over the operations of the investee firm, but not control; or

(3) business combinations - Control over the operations of the investee firm.

% ownership (or voting control) is main criteria but ultimately based on investor’s ability to influence or control the investee.

IFRS/US GAAP!

• Board representation.

• Involvement in policy

making.

• Material intercompany

transactions.

• Interchange of managerial

personnel.

• Dependence on

technology.