Page 9 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 9

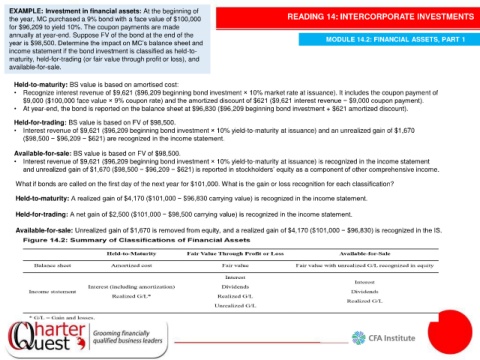

EXAMPLE: Investment in financial assets: At the beginning of

the year, MC purchased a 9% bond with a face value of $100,000 READING 14: INTERCORPORATE INVESTMENTS

for $96,209 to yield 10%. The coupon payments are made

annually at year-end. Suppose FV of the bond at the end of the MODULE 14.2: FINANCIAL ASSETS, PART 1

year is $98,500. Determine the impact on MC’s balance sheet and

income statement if the bond investment is classified as held-to-

maturity, held-for-trading (or fair value through profit or loss), and

available-for-sale.

Held-to-maturity: BS value is based on amortised cost:

• Recognize interest revenue of $9,621 ($96,209 beginning bond investment × 10% market rate at issuance). It includes the coupon payment of

$9,000 ($100,000 face value × 9% coupon rate) and the amortized discount of $621 ($9,621 interest revenue − $9,000 coupon payment).

• At year-end, the bond is reported on the balance sheet at $96,830 ($96,209 beginning bond investment + $621 amortized discount).

Held-for-trading: BS value is based on FV of $98,500.

• Interest revenue of $9,621 ($96,209 beginning bond investment × 10% yield-to-maturity at issuance) and an unrealized gain of $1,670

($98,500 − $96,209 − $621) are recognized in the income statement.

Available-for-sale: BS value is based on FV of $98,500.

• Interest revenue of $9,621 ($96,209 beginning bond investment × 10% yield-to-maturity at issuance) is recognized in the income statement

and unrealized gain of $1,670 ($98,500 − $96,209 − $621) is reported in stockholders’ equity as a component of other comprehensive income.

What if bonds are called on the first day of the next year for $101,000. What is the gain or loss recognition for each classification?

Held-to-maturity: A realized gain of $4,170 ($101,000 − $96,830 carrying value) is recognized in the income statement.

Held-for-trading: A net gain of $2,500 ($101,000 − $98,500 carrying value) is recognized in the income statement.

Available-for-sale: Unrealized gain of $1,670 is removed from equity, and a realized gain of $4,170 ($101,000 − $96,830) is recognized in the IS.