Page 99 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 99

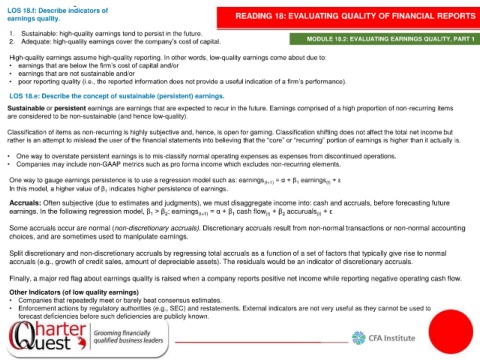

LOS 18.f: Describe indicators of

earnings quality. READING 18: EVALUATING QUALITY OF FINANCIAL REPORTS

1. Sustainable: high-quality earnings tend to persist in the future.

2. Adequate: high-quality earnings cover the company’s cost of capital. MODULE 18.2: EVALUATING EARNINGS QUALITY, PART 1

High-quality earnings assume high-quality reporting. In other words, low-quality earnings come about due to:

• earnings that are below the firm’s cost of capital and/or

• earnings that are not sustainable and/or

• poor reporting quality (i.e., the reported information does not provide a useful indication of a firm’s performance).

LOS 18.e: Describe the concept of sustainable (persistent) earnings.

Sustainable or persistent earnings are earnings that are expected to recur in the future. Earnings comprised of a high proportion of non-recurring items

are considered to be non-sustainable (and hence low-quality).

Classification of items as non-recurring is highly subjective and, hence, is open for gaming. Classification shifting does not affect the total net income but

rather is an attempt to mislead the user of the financial statements into believing that the “core” or “recurring” portion of earnings is higher than it actually is.

• One way to overstate persistent earnings is to mis-classify normal operating expenses as expenses from discontinued operations.

• Companies may include non-GAAP metrics such as pro forma income which excludes non-recurring elements.

One way to gauge earnings persistence is to use a regression model such as: earnings (t+1) = α + β earnings + ε

(t)

1

In this model, a higher value of β indicates higher persistence of earnings.

1

Accruals: Often subjective (due to estimates and judgments), we must disaggregate income into: cash and accruals, before forecasting future

earnings. In the following regression model, β > β : earnings (t+1) = α + β cash flow + β accuruals + ε

1

2

1

(t)

(t)

2

Some accruals occur are normal (non-discretionary accruals). Discretionary accruals result from non-normal transactions or non-normal accounting

choices, and are sometimes used to manipulate earnings.

Split discretionary and non-discretionary accruals by regressing total accruals as a function of a set of factors that typically give rise to normal

accruals (e.g., growth of credit sales, amount of depreciable assets). The residuals would be an indicator of discretionary accruals.

Finally, a major red flag about earnings quality is raised when a company reports positive net income while reporting negative operating cash flow.

Other Indicators (of low quality earnings)

• Companies that repeatedly meet or barely beat consensus estimates.

• Enforcement actions by regulatory authorities (e.g., SEC) and restatements. External indicators are not very useful as they cannot be used to

forecast deficiencies before such deficiencies are publicly known.