Page 118 - P6 Slide - Taxation - Lecture Day 1

P. 118

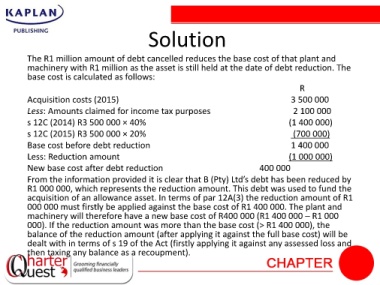

Solution

The R1 million amount of debt cancelled reduces the base cost of that plant and

machinery with R1 million as the asset is still held at the date of debt reduction. The

base cost is calculated as follows:

R

Acquisition costs (2015) 3 500 000

Less: Amounts claimed for income tax purposes 2 100 000

s 12C (2014) R3 500 000 × 40% (1 400 000)

s 12C (2015) R3 500 000 × 20% (700 000)

Base cost before debt reduction 1 400 000

Less: Reduction amount (1 000 000)

New base cost after debt reduction 400 000

From the information provided it is clear that B (Pty) Ltd’s debt has been reduced by

R1 000 000, which represents the reduction amount. This debt was used to fund the

acquisition of an allowance asset. In terms of par 12A(3) the reduction amount of R1

000 000 must firstly be applied against the base cost of R1 400 000. The plant and

machinery will therefore have a new base cost of R400 000 (R1 400 000 – R1 000

000). If the reduction amount was more than the base cost (> R1 400 000), the

balance of the reduction amount (after applying it against the full base cost) will be

dealt with in terms of s 19 of the Act (firstly applying it against any assessed loss and

then taxing any balance as a recoupment).