Page 119 - P6 Slide - Taxation - Lecture Day 1

P. 119

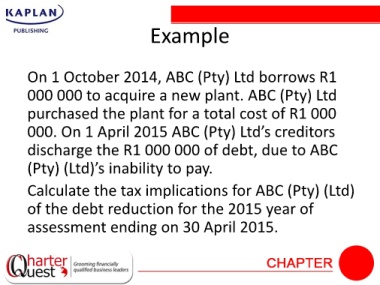

Example

On 1 October 2014, ABC (Pty) Ltd borrows R1

000 000 to acquire a new plant. ABC (Pty) Ltd

purchased the plant for a total cost of R1 000

000. On 1 April 2015 ABC (Pty) Ltd’s creditors

discharge the R1 000 000 of debt, due to ABC

(Pty) (Ltd)’s inability to pay.

Calculate the tax implications for ABC (Pty) (Ltd)

of the debt reduction for the 2015 year of

assessment ending on 30 April 2015.