Page 40 - P6 Slide - Taxation - Lecture Day 1

P. 40

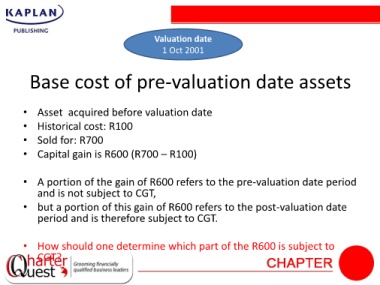

Valuation date

1 Oct 2001

Base cost of pre-valuation date assets

• Asset acquired before valuation date

• Historical cost: R100

• Sold for: R700

• Capital gain is R600 (R700 – R100)

• A portion of the gain of R600 refers to the pre-valuation date period

and is not subject to CGT,

• but a portion of this gain of R600 refers to the post-valuation date

period and is therefore subject to CGT.

• How should one determine which part of the R600 is subject to

CGT?