Page 44 - P6 Slide - Taxation - Lecture Day 1

P. 44

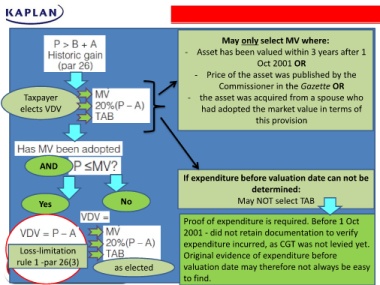

May only select MV where:

- Asset has been valued within 3 years after 1

Oct 2001 OR

- Price of the asset was published by the

Commissioner in the Gazette OR

Taxpayer - the asset was acquired from a spouse who

elects VDV had adopted the market value in terms of

this provision

AND

If expenditure before valuation date can not be

determined:

Yes No May NOT select TAB

Proof of expenditure is required. Before 1 Oct

2001 - did not retain documentation to verify

expenditure incurred, as CGT was not levied yet.

Loss-limitation Original evidence of expenditure before

rule 1 -par 26(3)

as elected valuation date may therefore not always be easy

to find.