Page 48 - P6 Slide - Taxation - Lecture Day 1

P. 48

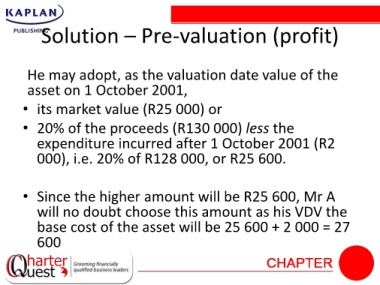

Solution – Pre-valuation (profit)

He may adopt, as the valuation date value of the

asset on 1 October 2001,

• its market value (R25 000) or

• 20% of the proceeds (R130 000) less the

expenditure incurred after 1 October 2001 (R2

000), i.e. 20% of R128 000, or R25 600.

• Since the higher amount will be R25 600, Mr A

will no doubt choose this amount as his VDV the

base cost of the asset will be 25 600 + 2 000 = 27

600