Page 46 - P6 Slide - Taxation - Lecture Day 1

P. 46

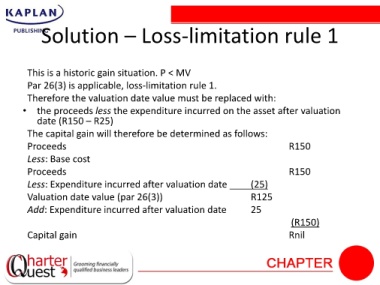

Solution – Loss-limitation rule 1

This is a historic gain situation. P < MV

Par 26(3) is applicable, loss-limitation rule 1.

Therefore the valuation date value must be replaced with:

• the proceeds less the expenditure incurred on the asset after valuation

date (R150 – R25)

The capital gain will therefore be determined as follows:

Proceeds R150

Less: Base cost

Proceeds R150

Less: Expenditure incurred after valuation date (25)

Valuation date value (par 26(3)) R125

Add: Expenditure incurred after valuation date 25

(R150)

Capital gain Rnil