Page 51 - P6 Slide - Taxation - Lecture Day 1

P. 51

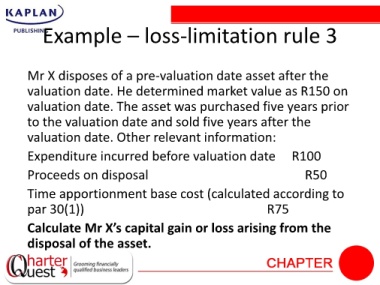

Example – loss-limitation rule 3

Mr X disposes of a pre-valuation date asset after the

valuation date. He determined market value as R150 on

valuation date. The asset was purchased five years prior

to the valuation date and sold five years after the

valuation date. Other relevant information:

Expenditure incurred before valuation date R100

Proceeds on disposal R50

Time apportionment base cost (calculated according to

par 30(1)) R75

Calculate Mr X’s capital gain or loss arising from the

disposal of the asset.