Page 52 - P6 Slide - Taxation - Lecture Day 1

P. 52

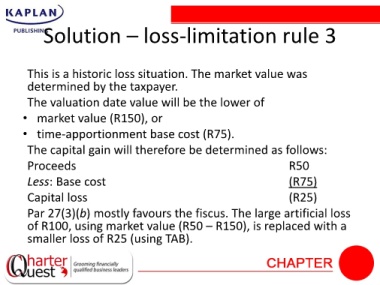

Solution – loss-limitation rule 3

This is a historic loss situation. The market value was

determined by the taxpayer.

The valuation date value will be the lower of

• market value (R150), or

• time-apportionment base cost (R75).

The capital gain will therefore be determined as follows:

Proceeds R50

Less: Base cost (R75)

Capital loss (R25)

Par 27(3)(b) mostly favours the fiscus. The large artificial loss

of R100, using market value (R50 – R150), is replaced with a

smaller loss of R25 (using TAB).