Page 50 - P6 Slide - Taxation - Lecture Day 1

P. 50

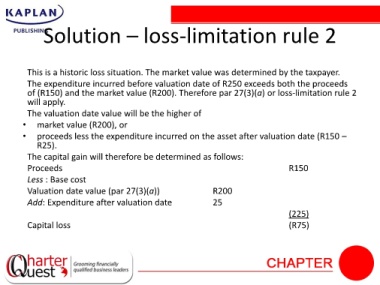

Solution – loss-limitation rule 2

This is a historic loss situation. The market value was determined by the taxpayer.

The expenditure incurred before valuation date of R250 exceeds both the proceeds

of (R150) and the market value (R200). Therefore par 27(3)(a) or loss-limitation rule 2

will apply.

The valuation date value will be the higher of

• market value (R200), or

• proceeds less the expenditure incurred on the asset after valuation date (R150 –

R25).

The capital gain will therefore be determined as follows:

Proceeds R150

Less : Base cost

Valuation date value (par 27(3)(a)) R200

Add: Expenditure after valuation date 25

(225)

Capital loss (R75)