Page 21 - PowerPoint Presentation

P. 21

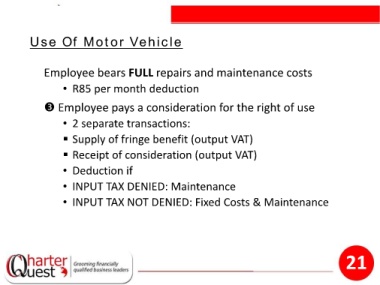

Use Of Motor Vehicle

Employee bears FULL repairs and maintenance costs

• R85 per month deduction

Employee pays a consideration for the right of use

• 2 separate transactions:

Supply of fringe benefit (output VAT)

Receipt of consideration (output VAT)

• Deduction if

• INPUT TAX DENIED: Maintenance

• INPUT TAX NOT DENIED: Fixed Costs & Maintenance

21