Page 23 - PowerPoint Presentation

P. 23

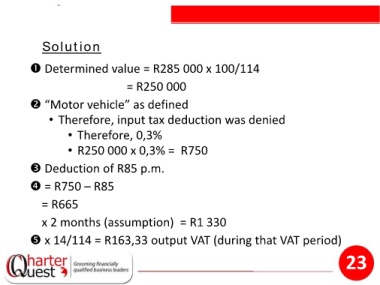

Solution

Determined value = R285 000 x 100/114

= R250 000

“Motor vehicle” as defined

• Therefore, input tax deduction was denied

• Therefore, 0,3%

• R250 000 x 0,3% = R750

Deduction of R85 p.m.

= R750 – R85

= R665

x 2 months (assumption) = R1 330

x 14/114 = R163,33 output VAT (during that VAT period)

23