Page 57 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 57

Session Unit 11:

38. Working Capital Management

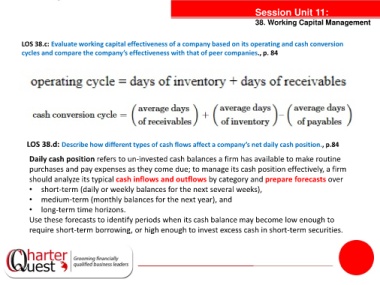

LOS 38.c: Evaluate working capital effectiveness of a company based on its operating and cash conversion

cycles and compare the company’s effectiveness with that of peer companies., p. 84

tanties

LOS 38.d: Describe how different types of cash flows affect a company’s net daily cash position., p.84

Daily cash position refers to un-invested cash balances a firm has available to make routine

purchases and pay expenses as they come due; to manage its cash position effectively, a firm

should analyze its typical cash inflows and outflows by category and prepare forecasts over

• short-term (daily or weekly balances for the next several weeks),

• medium-term (monthly balances for the next year), and

• long-term time horizons.

Use these forecasts to identify periods when its cash balance may become low enough to

require short-term borrowing, or high enough to invest excess cash in short-term securities.