Page 62 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 62

Accounts Payable Management, p. 89 Session Unit 11:

38. Working Capital Management

If the firm pays its payables prior to their due dates, cash is used unnecessarily and

interest on it is sacrificed. If a firm pays its payables late, it can damage relationships

with suppliers and lead to more restrictive credit terms or even the requirement that

purchases be made for cash. Late payment can also result in interest charges that are

high compared to other sources of short-term financing.

tanties

Typical terms on payables (trade credit) contain a discount available to those who pay quickly as

well as a due date. Terms of “2/10 net 60” mean that if the invoice is paid within ten days, the

company gets a 2% discount on the invoiced amount and that if the company does not take

advantage of the discount, the net amount is due 60 days from the date of the invoice.

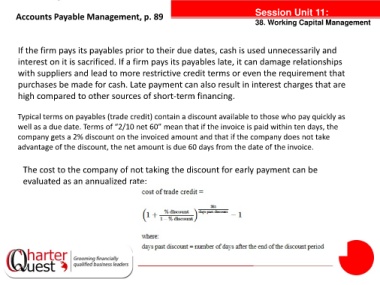

The cost to the company of not taking the discount for early payment can be

evaluated as an annualized rate: