Page 77 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 77

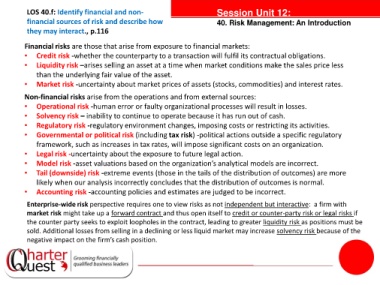

LOS 40.f: Identify financial and non- Session Unit 12:

financial sources of risk and describe how 40. Risk Management: An Introduction

they may interact., p.116

Financial risks are those that arise from exposure to financial markets:

• Credit risk -whether the counterparty to a transaction will fulfil its contractual obligations.

• Liquidity risk –arises selling an asset at a time when market conditions make the sales price less

than the underlying fair value of the asset.

• Market risk -uncertainty about market prices of assets (stocks, commodities) and interest rates.

Non-financial risks arise from the operations and from external sources:

• Operational risk -human error or faulty organizational processes will result in losses.

tanties

• Solvency risk – inability to continue to operate because it has run out of cash.

• Regulatory risk -regulatory environment changes, imposing costs or restricting its activities.

• Governmental or political risk (including tax risk) -political actions outside a specific regulatory

framework, such as increases in tax rates, will impose significant costs on an organization.

• Legal risk -uncertainty about the exposure to future legal action.

• Model risk -asset valuations based on the organization’s analytical models are incorrect.

• Tail (downside) risk -extreme events (those in the tails of the distribution of outcomes) are more

likely when our analysis incorrectly concludes that the distribution of outcomes is normal.

• Accounting risk -accounting policies and estimates are judged to be incorrect.

Enterprise-wide risk perspective requires one to view risks as not independent but interactive: a firm with

market risk might take up a forward contract and thus open itself to credit or counter-party risk or legal risks if

the counter party seeks to exploit loopholes in the contract, leading to greater liquidity risk as positions must be

sold. Additional losses from selling in a declining or less liquid market may increase solvency risk because of the

negative impact on the firm’s cash position.