Page 72 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 72

Other forms of Pooled

Investments, p.106 Session Unit 12:

39. Portfolio Management: An Overview

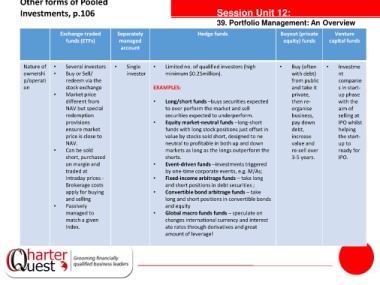

Exchange-traded Separately Hedge funds Buyout (private Venture

funds (ETFs) managed equity) funds capital funds

account

Nature of • Several investors • Single • Limited no. of qualified investors (high • Buy (often • Investme

ownershi • Buy or Sell/ investor minimum $0.25million). with debt) nt

p/operati redeem via the from public companie

on stock exchange EXAMPLES: and take it s in start-

• Market price private, up phase

different from • Long/short funds –buys securities expected then re- with the

NAV but special to over perform the market and sell organise aim of

redemption securities expected to underperform. business, selling at

•

Equity market-neutral funds –long-short

provisions tanties pay down IPO whilst

ensure market funds with long stock positions just offset in debt, helping

price is close to value by stocks sold short, designed to ne increase the start-

NAV. neutral to profitable in both up and down value and up to

• Can be sold markets as long as the longs outperform the re-sell over ready for

short, purchased shorts. 3-5 years. IPO.

on margin and • Event-driven funds –investments triggered

traded at by one-time corporate events, e.g. M/As;

intraday prices - • Fixed-income arbitrage funds – take long

Brokerage costs and short positions in debt securities ;

apply for buying • Convertible bond arbitrage funds – take

and selling long and short positions in convertible bonds

• Passively and equity

managed to • Global macro funds funds – speculate on

match a given changes international currency and interest

index. ate rates through derivatives and great

amount of leverage!