Page 71 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 71

Session Unit 12:

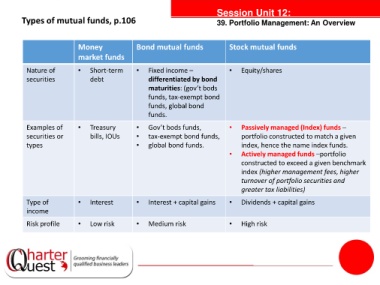

Types of mutual funds, p.106 39. Portfolio Management: An Overview

Money Bond mutual funds Stock mutual funds

market funds

Nature of • Short-term • Fixed income – • Equity/shares

securities debt differentiated by bond

maturities: (gov’t bods

funds, tax-exempt bond

funds, global bond

tanties

funds.

Examples of • Treasury • Gov’t bods funds, • Passively managed (Index) funds –

securities or bills, IOUs • tax-exempt bond funds, portfolio constructed to match a given

types • global bond funds. index, hence the name index funds.

• Actively managed funds –portfolio

constructed to exceed a given benchmark

index (higher management fees, higher

turnover of portfolio securities and

greater tax liabilities)

Type of • Interest • Interest + capital gains • Dividends + capital gains

income

Risk profile • Low risk • Medium risk • High risk