Page 70 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 70

LOS 39.e: Describe mutual funds and Session Unit 12:

compare them with other pooled 39. Portfolio Management: An Overview

investment products., p.105

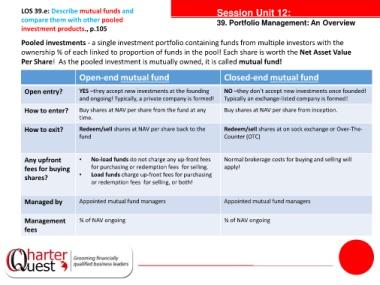

Pooled investments - a single investment portfolio containing funds from multiple investors with the

ownership % of each linked to proportion of funds in the pool! Each share is worth the Net Asset Value

Per Share! As the pooled investment is mutually owned, it is called mutual fund!

Open-end mutual fund Closed-end mutual fund

Open entry? YES –they accept new investments at the founding NO –they don’t accept new investments once founded!

and ongoing! Typically, a private company is formed! Typically an exchange-listed company is formed!

How to enter? Buy shares at NAV per share from the fund at any Buy shares at NAV per share from inception.

time. tanties

How to exit? Redeem/sell shares at NAV per share back to the Redeem/sell shares at on sock exchange or Over-The-

fund Counter (OTC)

Any upfront • No-load funds do not charge any up-front fees Normal brokerage costs for buying and selling will

fees for buying for purchasing or redemption fees for selling. apply!

shares? • Load funds charge up-front fees for purchasing

or redemption fees for selling, or both!

Managed by Appointed mutual fund managers Appointed mutual fund managers

Management % of NAV ongoing % of NAV ongoing

fees