Page 13 - PowerPoint Presentation

P. 13

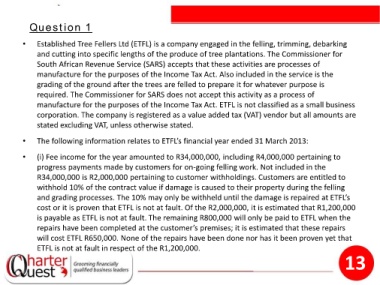

Question 1

• Established Tree Fellers Ltd (ETFL) is a company engaged in the felling, trimming, debarking

and cutting into specific lengths of the produce of tree plantations. The Commissioner for

South African Revenue Service (SARS) accepts that these activities are processes of

manufacture for the purposes of the Income Tax Act. Also included in the service is the

grading of the ground after the trees are felled to prepare it for whatever purpose is

required. The Commissioner for SARS does not accept this activity as a process of

manufacture for the purposes of the Income Tax Act. ETFL is not classified as a small business

corporation. The company is registered as a value added tax (VAT) vendor but all amounts are

stated excluding VAT, unless otherwise stated.

• The following information relates to ETFL’s financial year ended 31 March 2013:

• (i) Fee income for the year amounted to R34,000,000, including R4,000,000 pertaining to

progress payments made by customers for on-going felling work. Not included in the

R34,000,000 is R2,000,000 pertaining to customer withholdings. Customers are entitled to

withhold 10% of the contract value if damage is caused to their property during the felling

and grading processes. The 10% may only be withheld until the damage is repaired at ETFL’s

cost or it is proven that ETFL is not at fault. Of the R2,000,000, it is estimated that R1,200,000

is payable as ETFL is not at fault. The remaining R800,000 will only be paid to ETFL when the

repairs have been completed at the customer’s premises; it is estimated that these repairs

will cost ETFL R650,000. None of the repairs have been done nor has it been proven yet that

ETFL is not at fault in respect of the R1,200,000.

13