Page 16 - PowerPoint Presentation

P. 16

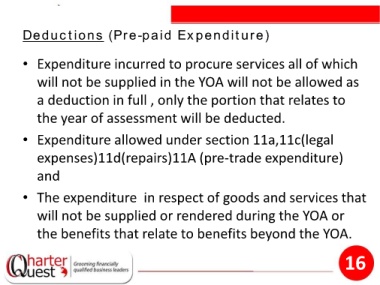

Deductions (Pre-paid Expenditure)

• Expenditure incurred to procure services all of which

will not be supplied in the YOA will not be allowed as

a deduction in full , only the portion that relates to

the year of assessment will be deducted.

• Expenditure allowed under section 11a,11c(legal

expenses)11d(repairs)11A (pre-trade expenditure)

and

• The expenditure in respect of goods and services that

will not be supplied or rendered during the YOA or

the benefits that relate to benefits beyond the YOA.

16