Page 14 - FINAL CFA SLIDES DECEMBER 2018 DAY 12

P. 14

LOS 41.g: Describe and interpret the minimum-

variance and efficient frontiers of risky assets and Session Unit 12:

the global minimum-variance portfolio., p.136 41. Portfolio Risk and Return: Part 1

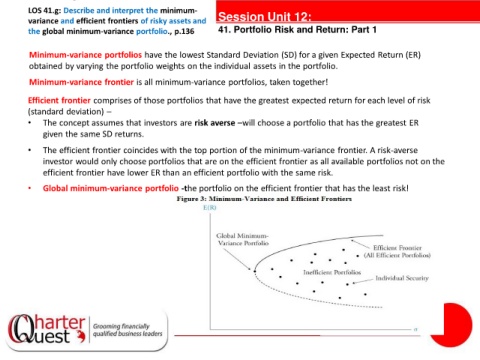

Minimum-variance portfolios have the lowest Standard Deviation (SD) for a given Expected Return (ER)

obtained by varying the portfolio weights on the individual assets in the portfolio.

Minimum-variance frontier is all minimum-variance portfolios, taken together!

Efficient frontier comprises of those portfolios that have the greatest expected return for each level of risk

(standard deviation) –

• The concept assumes that investors are risk averse –will choose a portfolio that has the greatest ER

given the same SD returns.

tanties

• The efficient frontier coincides with the top portion of the minimum-variance frontier. A risk-averse

investor would only choose portfolios that are on the efficient frontier as all available portfolios not on the

efficient frontier have lower ER than an efficient portfolio with the same risk.

• Global minimum-variance portfolio -the portfolio on the efficient frontier that has the least risk!