Page 15 - FINAL CFA SLIDES DECEMBER 2018 DAY 12

P. 15

LOS 41.h: Explain the selection of an optimal Session Unit 12:

portfolio, given an investor’s utility (or risk 41. Portfolio Risk and Return: Part 1

aversion) and the capital allocation line., p.137

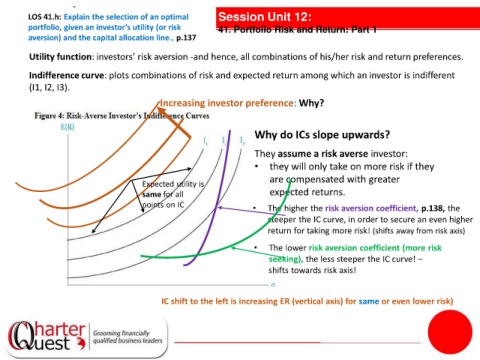

Utility function: investors’ risk aversion -and hence, all combinations of his/her risk and return preferences.

Indifference curve: plots combinations of risk and expected return among which an investor is indifferent

(I1, I2, I3).

Increasing investor preference: Why?

Why do ICs slope upwards?

tanties

They assume a risk averse investor:

•

they will only take on more risk if they

are compensated with greater

Expected utility is

same for all expected returns.

points on IC • The higher the risk aversion coefficient, p.138, the

steeper the IC curve, in order to secure an even higher

return for taking more risk! (shifts away from risk axis)

• The lower risk aversion coefficient (more risk

seeking), the less steeper the IC curve! –

shifts towards risk axis!

IC shift to the left is increasing ER (vertical axis) for same or even lower risk)