Page 31 - FINAL CFA SLIDES DECEMBER 2018 DAY 12

P. 31

Session Unit 12:

42. Portfolio Risk and Return: Part II

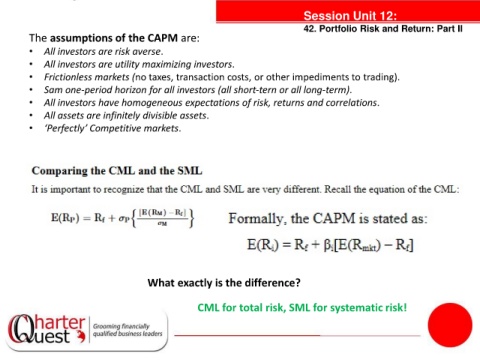

The assumptions of the CAPM are:

• All investors are risk averse.

• All investors are utility maximizing investors.

• Frictionless markets (no taxes, transaction costs, or other impediments to trading).

• Sam one-period horizon for all investors (all short-tern or all long-term).

• All investors have homogeneous expectations of risk, returns and correlations.

• All assets are infinitely divisible assets.

• ‘Perfectly’ Competitive markets.

tanties

What exactly is the difference?

CML for total risk, SML for systematic risk!