Page 33 - FINAL CFA SLIDES DECEMBER 2018 DAY 12

P. 33

Session Unit 12:

42. Portfolio Risk and Return: Part II

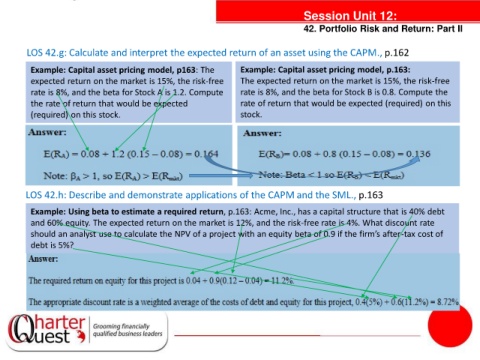

LOS 42.g: Calculate and interpret the expected return of an asset using the CAPM., p.162

Example: Capital asset pricing model, p163: The Example: Capital asset pricing model, p.163:

expected return on the market is 15%, the risk-free The expected return on the market is 15%, the risk-free

rate is 8%, and the beta for Stock A is 1.2. Compute rate is 8%, and the beta for Stock B is 0.8. Compute the

the rate of return that would be expected rate of return that would be expected (required) on this

(required) on this stock. stock.

tanties

LOS 42.h: Describe and demonstrate applications of the CAPM and the SML., p.163

Example: Using beta to estimate a required return, p.163: Acme, Inc., has a capital structure that is 40% debt

and 60% equity. The expected return on the market is 12%, and the risk-free rate is 4%. What discount rate

should an analyst use to calculate the NPV of a project with an equity beta of 0.9 if the firm’s after-tax cost of

debt is 5%?