Page 77 - Microsoft Word - 00 P1 IW Prelims.docx

P. 77

Corporate governance approaches

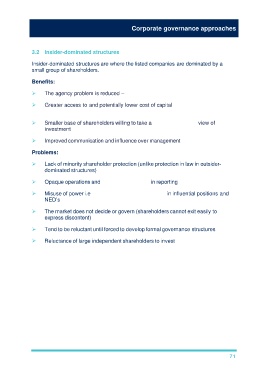

3.2 Insider-dominated structures

Insider-dominated structures are where the listed companies are dominated by a

small group of shareholders.

Benefits:

The agency problem is reduced – i.e. establish links with owners and managers

Greater access to and potentially lower cost of capital i.e. smaller base of

shareholders

Smaller base of shareholders willing to take a long term strategic view of

investment

Improved communication and influence over management

Problems:

Lack of minority shareholder protection (unlike protection in law in outsider-

dominated structures)

Opaque operations and lack of transparency in reporting

Misuse of power i.e. reluctance to employ outsiders in influential positions and

NED’s

The market does not decide or govern (shareholders cannot exit easily to

express discontent)

Tend to be reluctant until forced to develop formal governance structures

Reluctance of large independent shareholders to invest

71