Page 235 - BA2 Integrated Workbook - Student 2017

P. 235

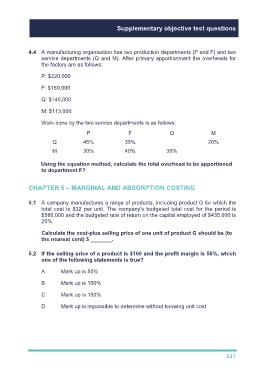

Supplementary objective test questions

4.4 A manufacturing organisation has two production departments (P and F) and two

service departments (Q and M). After primary apportionment the overheads for

the factory are as follows:

P: $220,000

F: $160,000

Q: $140,000

M: $113,000

Work done by the two service departments is as follows:

P F Q M

Q 45% 35% 20%

M 30% 40% 30%

Using the equation method, calculate the total overhead to be apportioned

to department F?

CHAPTER 5 – MARGINAL AND ABSORPTION COSTING

5.1 A company manufactures a range of products, including product G for which the

total cost is $32 per unit. The company's budgeted total cost for the period is

$580,000 and the budgeted rate of return on the capital employed of $435,000 is

20%.

Calculate the cost-plus selling price of one unit of product G should be (to

the nearest cent) $ _______.

5.2 If the selling price of a product is $100 and the profit margin is 50%, which

one of the following statements is true?

A Mark up is 50%

B Mark up is 100%

C Mark up is 150%

D Mark up is impossible to determine without knowing unit cost

227