Page 238 - BA2 Integrated Workbook - Student 2017

P. 238

Fundamentals of Management Accounting

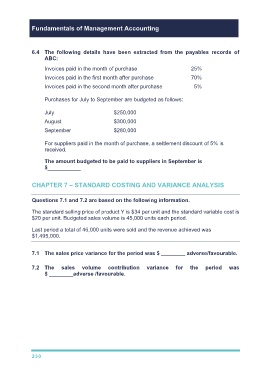

6.4 The following details have been extracted from the payables records of

ABC:

Invoices paid in the month of purchase 25%

Invoices paid in the first month after purchase 70%

Invoices paid in the second month after purchase 5%

Purchases for July to September are budgeted as follows:

July $250,000

August $300,000

September $280,000

For suppliers paid in the month of purchase, a settlement discount of 5% is

received.

The amount budgeted to be paid to suppliers in September is

$___________

CHAPTER 7 – STANDARD COSTING AND VARIANCE ANALYSIS

Questions 7.1 and 7.2 are based on the following information.

The standard selling price of product Y is $34 per unit and the standard variable cost is

$20 per unit. Budgeted sales volume is 45,000 units each period.

Last period a total of 46,000 units were sold and the revenue achieved was

$1,495,000.

7.1 The sales price variance for the period was $ ________ adverse/favourable.

7.2 The sales volume contribution variance for the period was

$ ________adverse /favourable.

230