Page 262 - BA2 Integrated Workbook - Student 2017

P. 262

Fundamentals of Management Accounting

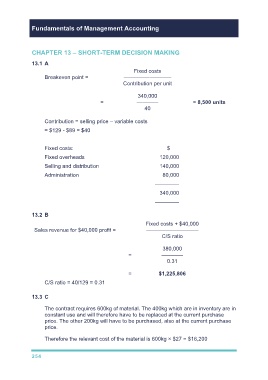

CHAPTER 13 – SHORT-TERM DECISION MAKING

13.1 A

Fixed costs

Breakeven point = ——–––––————

Contribution per unit

340,000

= ———— = 8,500 units

40

Contribution = selling price – variable costs

= $129 - $89 = $40

Fixed costs: $

Fixed overheads 120,000

Selling and distribution 140,000

Administration 80,000

––––––––

340,000

––––––––

13.2 B

Fixed costs + $40,000

Sales revenue for $40,000 profit = ———–––—————

C/S ratio

380,000

= ————

0.31

= $1,225,806

C/S ratio = 40/129 = 0.31

13.3 C

The contract requires 600kg of material. The 400kg which are in inventory are in

constant use and will therefore have to be replaced at the current purchase

price. The other 200kg will have to be purchased, also at the current purchase

price.

Therefore the relevant cost of the material is 600kg × $27 = $16,200

254