Page 30 - FINAL CFA I SLIDES JUNE 2019 DAY 2

P. 30

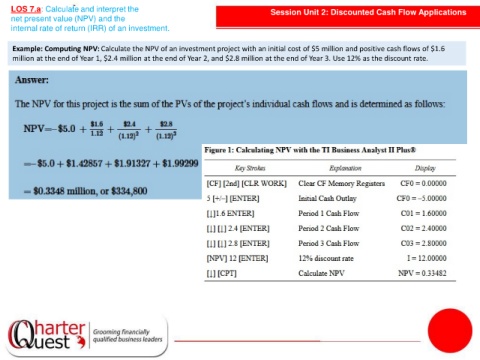

LOS 7.a: Calculate and interpret the Session Unit 2: Discounted Cash Flow Applications

net present value (NPV) and the

internal rate of return (IRR) of an investment.

Example: Computing NPV: Calculate the NPV of an investment project with an initial cost of $5 million and positive cash flows of $1.6

million at the end of Year 1, $2.4 million at the end of Year 2, and $2.8 million at the end of Year 3. Use 12% as the discount rate.