Page 35 - FINAL CFA I SLIDES JUNE 2019 DAY 2

P. 35

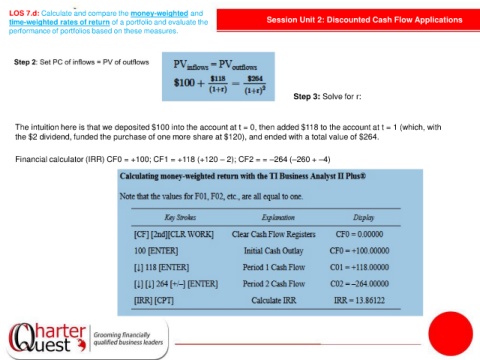

LOS 7.d: Calculate and compare the money-weighted and

time-weighted rates of return of a portfolio and evaluate the Session Unit 2: Discounted Cash Flow Applications

performance of portfolios based on these measures.

Step 3: Solve for r:

The intuition here is that we deposited $100 into the account at t = 0, then added $118 to the account at t = 1 (which, with

the $2 dividend, funded the purchase of one more share at $120), and ended with a total value of $264.

Financial calculator (IRR) CF0 = +100; CF1 = +118 (+120 – 2); CF2 = = –264 (–260 + –4)