Page 18 - FINAL CFA SLIDES DECEMBER 2018 DAY 4

P. 18

Session Unit 2:

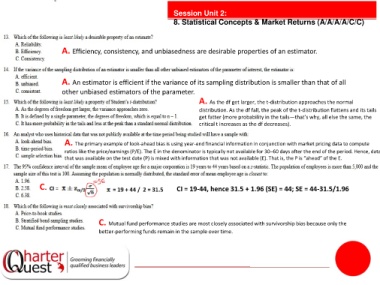

8. Statistical Concepts & Market Returns (A/A/A/A/C/C)

A. Efficiency, consistency, and unbiasedness are desirable properties of an estimator.

A. An estimator is efficient if the variance of its sampling distribution is smaller than that of all

other unbiased estimators of the parameter.

A. As the df get larger, the t-distribution approaches the normal

distribution. As the df fall, the peak of the t-distribution flattens and its tails

get fatter (more probability in the tails—that’s why, all else the same, the

critical t increases as the df decreases).

A. The primary example of look-ahead bias is using year-end financial information in conjunction with market pricing data to compute

ratios like the price/earnings (P/E). The E in the denominator is typically not available for 30–60 days after the end of the period. Hence, data

that was available on the test date (P) is mixed with information that was not available (E). That is, the P is “ahead” of the E.

C. CI = 19-44, hence 31.5 + 1.96 (SE) = 44; SE = 44-31.5/1.96

C. Mutual fund performance studies are most closely associated with survivorship bias because only the

better-performing funds remain in the sample over time.