Page 23 - FINAL CFA SLIDES DECEMBER 2018 DAY 4

P. 23

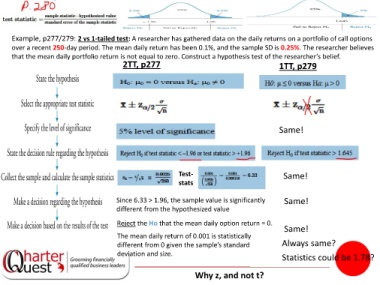

Example, p277/279: 2 vs 1-tailed test: A researcher has gathered data on the daily returns on a portfolio of call options

over a recent 250-day period. The mean daily return has been 0.1%, and the sample SD is 0.25%. The researcher believes

that the mean daily portfolio return is not equal to zero. Construct a hypothesis test of the researcher’s belief.

2TT, p277 1TT, p279

Same!

Test- Same!

stats

Since 6.33 > 1.96, the sample value is significantly Same!

different from the hypothesized value

Reject the Ho that the mean daily option return = 0.

Same!

The mean daily return of 0.001 is statistically

different from 0 given the sample’s standard Always same?

deviation and size. Statistics could be 1.78?

Why z, and not t?