Page 6 - FINAL CFA SLIDES DECEMBER 2018 DAY 4

P. 6

Session Unit 3:

11. Sampling and Estimation

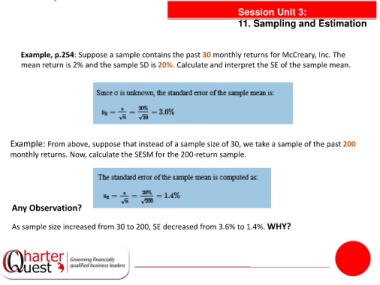

Example, p.254: Suppose a sample contains the past 30 monthly returns for McCreary, Inc. The

mean return is 2% and the sample SD is 20%. Calculate and interpret the SE of the sample mean.

Example: From above, suppose that instead of a sample size of 30, we take a sample of the past 200

monthly returns. Now, calculate the SESM for the 200-return sample.

Any Observation?

As sample size increased from 30 to 200, SE decreased from 3.6% to 1.4%. WHY?